Are you doing less than $5M of revenue as an MSP? In this latest episode of The Business of Tech, The Host Broker’s Hartland Ross joins Dave Sobel to talk about deal dynamics for MSP earning less than $5M in revenue per year.

If you enjoy this video, you might also want to check our previous interview with Dave Sobel where we discussed trends in managed services. Watch it here!

The Host Broker offers a free evaluation for owners of IT services businesses considering exiting. Learn about the acquisition process and find out what your company may be worth on the market.

Contact us to learn more about the dynamics of MSP and how to start earning more than $5M revenue in a year.

The decision to sell your IT business is never easy. When you’ve spent years building something from the ground up, you want to make sure that your business continues to thrive, even without your day-to-day involvement.

Whether you’re thinking of selling because you want to retire, change industries, or have access to more opportunities post-merger, you only get one chance to do it right. That’s why having a partner you can trust during this process is critical.

Working with a business broker who specializes in your industry means relying on the expertise of someone who understands your business and can guide you to the best outcome, navigating all the nuances based on the experience of closing hundreds of successful deals in the past.

The Host Broker has been connecting buyers and sellers in the IT services industry since 2005. We’ve successfully completed hundreds of transactions for hosting companies, MSPs, ISPs, data centers, IaaS and SaaS providers, IT security firms, systems integrators, and more. As a result, we have an unmatched expertise when it comes to selling or buying companies in the IT sector. The best part — our services are free for sellers, since it’s the buyers who pay our fee.

When you’re thinking of selling your IT company, you might wonder if trying to find a buyer on your own or calling up a generic M&A broker is a good idea. It’s not.

Here are the top 7 reasons why collaborating with an IT business broker will help you land better results for your business.

Unlike generic M&A brokers who advise on anything from grocery chains to gas stations, we specialize only in IT. That means we know the industry inside out.

We know what it’s like to build an IT business from scratch. In fact, our sister company eBridge Marketing offers a wide range of digital marketing services for IT companies worldwide.

We have up-to-date experience with new technologies and understand how they change the dynamics of the market. What’s more, our knowledge is cumulative and our industry insights get better with every complete deal.

More often than not, selling your business to a larger company comes with a lot of stress. M&A advisors and lawyers from the other side will try to overwhelm you with jargon during due diligence and pressure you into accepting a low-ball offer as a result. These are just the realities of business.

Our experience allows us to quickly estimate fair valuations and help you negotiate deals that undervalue your business. And if you’re not sure what EBITDA, TTM, TEV, LOI, APA and SPA are — you don’t have to stress, we’ll walk you through the whole process step by step.

The business world is too large for any one company to keep track of. If you think that you can get the best price for your business by sending emails to a few local companies you like, think again.

Expanding the pool of potential buyers and introducing more competition is one of the best ways to maximize the acquisition price.

At the Host Broker, we’ve been building up a marketplace of global buyers and sellers for nearly 20 years. Our buyers have the capital and the desire to acquire high-quality IT companies — it’s the ideal place for any seller to be.

Selling your business is not just about the price — it’s about finding the right home for your life’s work. Asking the right questions is key to finding the perfect buyer, making sure the deal goes through, and being confident in how your business will continue to operate in the future.

Whether it’s general, financial, or operational questions, we know exactly what to ask to get the full picture you need to make a decision.

All acquisitions are complex processes with hundreds of moving parts, which means that lots of things can go wrong at any given moment.

That’s why working with a broker who can take all the necessary precautions can be so helpful. You don’t want to end up in a situation where a deal you’ve been working on for months falls apart because of something that wasn’t clarified in the beginning.

In facilitating acquisitions, and connecting buyers and sellers, we’ve been building a thriving marketplace of our own for nearly two decades. For us, reputation is everything. We don’t cut corners to make a quick buck and don’t try to cram as many transactions in every quarter as possible.

We are focused on the outcome and are only satisfied when both the seller and the buyer are happy with their deal.

As an IT business broker, we are paid by the buyers and our services are free for the sellers. That means you can get all the advice, guidance, and help outlined above, and keep 100% of the proceeds from the sale as well.

When you work with the Host Broker, you significantly expand your potential buyers’ market, improve the chances of getting a better price, decrease the likelihood of the deal blowing up, and get to sell your business to the buyer you really trust.

Start exploring the opportunity of selling your business today by getting a free evaluation. Contact us or call us at 1-888-436-5262 if you have any questions or want to know what the process of selling your business might look like.

If you’re an owner of an MSP, web hosting company, or other types of IT service and you’re looking to sell your business, there are a lot of factors to consider. Here are 18 questions you’ll want to put forward to potential buyers before signing a letter of intent or purchase agreement:

Do you have any questions of your own about selling your IT service provider? Please contact us today.

For MSP owners, web hosting companies, and other IT service providers, the proposition of selling their company can seem confusing and daunting. This video features Hartland Ross from The Host Broker clearing up what you need to know and what you can expect with the sell side process.

You can also check out our Comic Book which gives an overview of what the process is like from a Seller’s perspective.

Valuations for managed service providers and IT firms are increasing, and we’re seeing higher prices across locations and sectors. We’ve seen a number of factors driving higher valuations, leading to a market that is hotter than it has been in years. What this means for business owners is significant. On one hand, this may represent the right time to exit the business through a sale. On the other hand, there are compelling reasons to seek an acquisition to drive meaningful growth for your business.

In our view, these prices are not artificially high, because there are identifiable reasons that IT and managed service organizations are growing in value. From improved appetite in the broader market for IT services, to an increase in acquirer interest all around the globe, this post will examine why prices for IT and managed services organizations continue to rise. Further, we will explore how both buyers and sellers can make the most of the current market conditions.

One of the primary drivers of increased valuations for managed service providers and IT firms is the overall growth of the tech sector. In recent years, there has been a surge in demand for tech products and services across industries, as businesses of all sizes look to improve their digital capabilities. This has led to strong growth for many companies in the sector, and investors are eager to get a piece of the action. As a result, they are willing to pay premium prices for quality companies in the space.

This trend is likely to continue in the years ahead, as the demand for technology continues to grow, and as our digital transformation settles in. Businesses are increasingly reliant on digital tools, and that reliance is only going to increase over time. As a result, the tech sector is likely to continue its rapid growth, leading to even higher valuations for companies in the space.

In recent years, there has been a surge in M&A activity as big firms have looked to acquire smaller ones to gain market share. This has put pressure on buyers to act quickly and to offer top dollar when they find a company they’re interested in acquiring.

Another factor that is driving consolidation is the shortage of qualified workers in the IT sector. With the rapid growth of the industry, there are not enough workers to meet demand. This has led to a situation where companies are willing to pay a premium to acquire talent. In some cases known as acqui-hires, the primary motivation for the acquisition isn’t to add new customers or lines of business, it’s to bring aboard the target company’s employees.

While this consolidation trend has been happening for a while, it’s likely to continue in the coming years. Ultimately, ongoing industry consolidation suggests sellers can expect high valuations for their businesses.

The COVID-19 pandemic has had a major impact on the IT sector, accelerating demand for many products and services. For example, the shift to remote work has led to an increase in demand for cloud computing and other virtualization technologies. And as businesses look to improve their digital capabilities, they are increasingly turning to managed service providers for help.

These changing work norms for businesses around the world have also changed the services required from MSPs. Employees working remotely means that security and operations extend outside of the traditional workplace in ways they never have before. Businesses are more reliant on their tech partners than ever before.

Another factor brought on by the pandemic pertains to owners of IT firms nearing retirement age. For many of these owners, there were difficult challenges with customers, partners, and vendors in 2020, 2021, and even into 2022. And for some, these headaches accelerated their retirement plans, becoming the onus for entering the market as a seller.

We are seeing new types of buyers enter the market for IT and managed service providers. In particular, we are seeing more foreign buyers and those in cross-functional industries showing interest. This is adding even more competition to the market and driving up prices.

It isn’t just buyers in other American locations coming to the table. Buyers from other countries and continents are coming to the table with aggressive offers as well. These acquisitions are being made for strategic reasons, the expansion of the provider’s service area, or for wholly financial reasons that have nothing to do with technology, staff, or capability at all.

In addition to foreign buyers, in recent years, there has been a growing trend of private equity firms going downmarket (evaluating smaller firms than they would have in the past) in the managed services space. This trend is being driven by a number of factors, including the desire to add new capabilities to existing portfolios and the increasing importance of digital transformations.

Finally, it would be a mistake to not consider the role of inflation in rising prices. Inflation is impacting the economy across the board. While six or eight months ago inflation was primarily affecting automobiles and gasoline, the devaluation of a currency relative to goods and services is now touching everything from food to aluminum. This broad wave pushing the economy to and fro certainly impacts the value of IT businesses looking to sell.

Critically, this impact is felt in different ways by buyers and sellers. For buyers, the raw number of an offer must be higher on account of inflation. For sellers, they are also likely considering the downstream or longer term effects of inflation by wondering to themselves: “if this continues, I’ll need even more money to comfortably retire or start a new venture. I’m not just thinking about now, I’m also thinking about five or ten years from now.”

While predicting the future of the IT and MSP market is as much supposition as science, market trends and conditions do indicate continued growth. Because no single factor is driving prices up then it stands to reason that the combination of factors at play will continue. For example, if there were a scarcity of IT companies, then that might drive prices higher until more companies came to market. However, a wide range of things is pushing valuations higher in different locations and segments of the IT space.

That, combined with the entrance of a larger buyer pool into the market indicates that IT and managed service providers will continue to be valued highly.

However, there is one caveat worth considering: commoditized services. Some services like basic network monitoring and help desk continue to head towards the realm of commoditization. In this scenario, customers have a hard time differentiating the quality of service between providers. These companies will struggle to keep up with the valuation growth that other, more specialized companies are experiencing. IT providers that offer a very deep and specific service – think modernizing legacy IBM workloads to work in a hybrid cloud or pen testing for public utilities or of course MSSPs – will continue to see increases in value.

There are a few things that both buyers and sellers can do to make the most of the current market conditions. It’s important to have a clear understanding of what you’re looking for and what your goals are. This will help you to narrow your search and focus on the right opportunities. Make sure to do your due diligence. With prices as high as they are and with the risk of overpaying, it’s even more important to make sure that you’re getting what you’re paying for if you are an acquirer. If you are a seller, it is important to find an acquirer that meets not only your financial goals but also to ensure there is a cultural fit and that your timeline for a complete exit is met.

Be prepared to act quickly and pay a premium price.

Look for companies that are in high-demand sectors such as cloud computing and virtualization.

Consider acquiring talent through an “acqui-hire.”

Now is a great time to sell your company. Valuations are at all-time highs.

Be prepared to negotiate hard and get the best price for your business.

Focus on buyers who are willing to pay a premium price and close quickly.

With the market for IT and managed service providers heating up, prices are increasing across locations and sectors. There are a number of factors driving this increase, including broader growth in the tech sector, consolidation as seen previously, COVID and work from home, hiring and resource needs – “acqui-hire”, and new segments of buyers including foreign buyers and those in cross-functional industries. With all of these factors at play, it’s no wonder that prices are on the rise, and will likely continue to be.

Here at The Host Broker, we have helped hundreds of managed service providers and IT organizations through the acquisition process. We match buyers to sellers and serve as a trusted advisor throughout the process. Our team has the dedication, care, and expertise necessary to make the purchase or sale of an IT company a success. Contact us here to learn more about how The Host Broker can help when it’s time to buy or sell a hosting company, IT organization, or managed service provider.

While a successful acquisition can be a major achievement for both buyer and seller, for employees the acquisition process is seen much differently. It is abrupt and the source of concern. Join us for an expert panel about the perspectives of employees going through an acquisition, and learn how you can address their concerns to ensure a smooth transition for all parties.

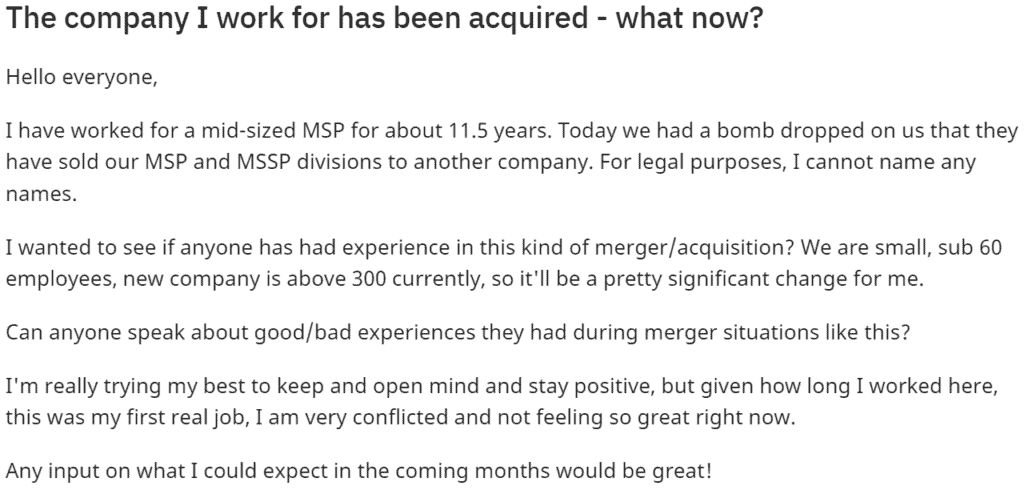

Devin: All righty. Well, thanks to everyone for joining us today. I’m really excited to be bringing us this webinar panel today. And I tell you what, you know, I say this for a lot of our webinars that we have some great guests, but today I really mean it. We have three exceptional guests. We have James Kernan, Tom Parker, and Troy Thibert. And the topic of today’s presentation is The Company I Work For Has Been Acquired What Now?

And this was a topic that we came up with and we were inspired by an actual post from the MSP subreddit. And I won’t read the entire thing here. You can pause the video and read it if you’d like, but just to quickly paraphrase, the topic was same as ours.

The company I work for has been acquired what now? And, the poster says I’ve worked for a mid-size MSP for 11 years. We had a bomb dropped on us that we’re gonna be sold to another company. Can anyone speak about good or bad experiences they’ve had during a merger situation like this? I’m really trying my best, and to keep an open mind and stay positive, but given how long I’ve worked here, and this was my first real job, I’m very conflicted not feeling so great right now. Any input about what I could expect in the coming months would be great.

So this struck me as, quite an interesting post, just because of the candor of the poster. And it comes across quite clearly that there’s some concerns and really deep-rooted concerns, that this employee is feeling about this acquisition process. So we want to put together a presentation to kind of address some of these concerns, not only from the perspective of an employee but also from the perspective of a buyer or seller of a company, who has to essentially help deal with the concerns of the employees to make sure that the transition goes smoothly.

Devin: So, before we really get into the presentation today, I want to say a little bit about The Host Broker. if you’re watching this video, you’re probably already familiar with The Host Broker, but we are a brokerage and M&A firm for IT service providers, including MSPs, web hosting companies, data centers, IT service firms. And also we sell IP blocks, and we also offer marketing services through our other brand, which is eBridgemarketingsolutions.com. The Host Broker was actually founded in 2005 as spin-off from eBridge due to client demand. We had enough companies asking us for marketing growth opportunities, and we started to offer M&A growth opportunities as well. And if you’re interested in more information, you can check out our website, thehostbroker.com, where we have a free evaluation available for you.

It’s now for a little bit more information about our panelists, and, I’ll ask each panelist to introduce themselves briefly here. And just tell us a little bit about your experiences with M&A, so James, do you maybe wanna start us off and tell us a little bit about yourself?

James: Yeah, you bet. thanks Devin. And I’m, happy to be here. I’m James Kernan with Kerning Consulting. We’re headquartered here in Omaha, Nebraska. So, we’re based in the States. I’ve been in the industry now for close to 30 years, but the first half of my career, I owned my own MSP and Southern California. you know, bought sold owner, ran seven different companies, had a successful exit in around 2006. And then since then just really stumbled into, consulting and coaching. Since then I have been involved in over two dozen M&A transactions, either helping people grow by acquisition or grow their business and, and sell and exit. I also run the millionaire mastermind peer groups and do one-on-one coaching and then special projects like M&A consulting, and so forth, but happy to be here.

Devin: Great. Thanks James. And Tom, do you mind telling us a little bit about yourself and your experience?

Tom: Yeah, thanks very much for having me today. Glad to be here. So, I am working with HostPapa. I’ve been in the tech industry for around 20 odd years. The first half of my career was predominantly on corporate sales and biz dev, in the last 10 years or so I’ve been with HostPapa, and, we’ve been very, very active in the M&A space. So, HostPapa for those of you that aren’t familiar with us, is Canadian owned and operated based in Ontario. We are the largest web host in Canada in terms of Canadian ownership. Since about 2019, we’ve been extremely busy, as I mentioned, with M&A, we’ve probably done an excess of 15 deals for predominantly web hosting companies, but also a variety of technologies and other activities. So, that’s really the connection with The Host Broker. They, as those of you that are familiar with them, we’ll know, great service and, a great relationship there. So, that’s our background.

Devin: Great. Thanks, Tom. And Troy, do you wanna tell us a little bit about yourself as well?

Troy: Yeah, absolutely. First off, thank you, Hartland and Devin for the invite, greatly appreciate it. Yy name’s Troy Thibert, and I’m the owner of an IT firm called IT Partners who originated in grand Prairie Alberta with, well, I guess with a city, population of just under 50,000 at that time, we’ve since grown it to operate, with offices in Calgary, Alberta, Vancouver, Victoria, and operations in west, and you know, in Edmonton as well. So, we started this in 2010, and every year of our existence, we’ve grown in revenue. From our model, right up until 2022. During that 12 years we’ve been successful in three types of growth, through acquisition and mergers. Two are asset purchase agreements. There is a difference. And then of course, last year, with Hartland’s group, I finally pulled the trigger on a share purchase agreements, which is a different leave, path forward as well.

But it also has very good potential exit strategies that come with it. So yeah, So I’m gonna be speaking where I can assist on, you know, from the buyer side and, and what I look for. And maybe one of the things that I’m missing other than the three successes is probably the 16 to 18 conversations, that I, we walked away from for whatever reasons, but they’re just as equally as important for potential buyers to, to watch out for pitfalls to take the knowledge that I believe James is gonna bring as well, and to why you’re going to set up certain, processes and structures within your corporation, so that when it comes to your exit, you’re gonna get the most value for that exit. And so I look forward to contributing and hopefully provide some value to, you know, to some potential buyers out there.

Devin: Great, thanks to that Troy. And last but not least, Hartland.

Hartland: Yeah. Thanks, everyone for participating. And I really wanna thank, James, Troy and Tom for, joining us today and I’ll have a somewhat unique perspective, from them, as well, both, looking at this from a hosting perspective, as well as MSPs, as well as buyers, as well as, sell side. So, being I’m looking forward to today, I think it’ll be a very interesting discussion. I founded eBridge just over 20 years ago, as, Devin said, focused on really, IT firms and growing them organically. And then, we just ended up with a lot of those groups that for one reason or another wanted to kind of grow more quickly, than they could organically or in some cases, less expensively. And so, we ended up, building out, frankly just with, with clients, asking, building out a kind of informal marketplace, if you like. And, that turned into, The Host Broker and so, you know, today we worked with, literally like over a thousand, IT firms, collectively, whether it be hosting or data centers or MSPs or whatnot. So, look forward to today and, let’s get started. So, Devin over to you.

Devin: Great, thanks Harland. You know, and as it was illustrated in the Reddit post we shared earlier, going this through, an acquisition from an employee’s perspective can be very chaotic and there’s a lot of different variables. So, for the purposes of today’s presentation, we wanted to kind of simplify the issue by providing a little bit of a framework. And so, we’ve categorized the types of concerns that employees have into four different categories. We have day to day, financial, cultural, and technological, and recognizing that there’s gonna be some overlap between these, hopefully by keeping to this sort framework. We’ll make this a little bit more digestible today.

Devin: So, let’s start off with the day to day concerns. So, when we’re talking about these, we’re thinking about things like, what change can I expect as a result of this transaction? Who will I be reporting to? Where will work actually be conducted? Will I, or any of my coworkers lose our jobs? So when it comes to those sorts of day to day concerns, maybe James, maybe I can start off with you. Is there anything that comes to mind, but how you would coach the MSPs that you work with to guide their employees, and to help them help to help ease the employee concerns?

James: Yeah, so the first three questions, I would kind of peel off on one side and then, you know, will I, or any coworkers lose our job to me, that’s something separate that needs to be addressed immediately. And, you know, there’s a lot of training. Normally the leadership team will come together and select, you know, I break it down into three categories, people, process, and tools or technology. Normally it’s the acquiring company. You’ve got your tools and processes already, so there’s gonna be a lot of training of the new employees, but, I just wanted to tell a quick story if I could, Devin, and to put things in perspective that the post that you read from Reddit reminded me of the human element of things. And I’m a numbers person. I was a young executive with a big VA on the west coast. And, the first acquisition that I was a part of to hop on an airplane. And we, it was a company called technology integration group, but we bought the microwave of Honolulu. It was, they were based in Honolulu. They’d been around for 20 years. Unfortunately, it kind of looked like a VCR repair shop when you first walked into the shop, but the whole plane right over there, I was looking at all the numbers, all the contracts, the resumes of the staff, compensation. I was kind of going through all the numbers element of it and that’s important. But when I walked in through the front lobby and all of a sudden in the tech support area, there were about 25 human beings, all looking at me. And I walked in with the President and I was Vice President of Sales and Marketing.

And immediately, everybody kind of pointed the finger at me to start the conversation. And before I could say anything, it just, I remember vividly, like it was yesterday. I remember looking at everybody’s eyes and the number one concern, I felt them communicating, or I could see in their eyes was, you know, am I gonna have a job? Am I gonna, is me or any of my coworkers gonna lose their job? And I didn’t have this all prepared. It just kind of came to me. But the very first thing I said was, hey, welcome to the team, welcome aboard. We’re excited to be here. We’re to give you guys an update. The first thing I want to say to everybody is everybody in the room right now is gonna stay here. And there were, there were a couple people I knew we peeled out and had already left the company, know the original owner, was gonna leave the company and then like the accounting person and the purchasing person because central operations were gonna be handled through the corporate office, but everybody else, you know, sales administration and technical support, we needed everybody else.

But to me, that’s, I wanna, you can get caught up in the numbers really quick and, and see if it’s a culture fit and all that. But it’s the people side that, is really important. So, I would carve that out first. So I hope I kind of answered your question, but I remember saying that to everybody and I could just feel the energy in the room, like, you know, everybody kind of relaxed, and then we could talk about some of the other things, we had a training schedule over the next couple days of getting people trained on ours systems, setting goals and expectations. But one of the other things I said, I don’t know if it makes a whole lot of sense today. It’s kind of funny, but I just said, Hey, the first thing I’m going to do here is nothing.

And what I meant by that was I wanna listen. I wanna have one-on-ones with everybody in the team. And I wanted to understand the culture there. But I wasn’t gonna rapidly just start changing everything in the world because, they had their own culture and it was unique. And I wanted to embrace that and understand that before we blended another culture on top of that. So that was, you know, I probably should have said the first thing I’m going to do is do one on ones and, and listen, that’s what I meant. I wanted to listen to all their feedback before we implemented any changes.

Devin: Very interesting. Troy, Tom, and Hartland. Any thoughts on that?

Troy: Yeah, I can go. I think I’d like to maybe offer, you know, I think is some key advice and maybe just taking it, a step, precursor to the questions that are gonna compost announcement. And, that is really, doing the due diligence process is when you’re identifying key resources, the length and term they’ve been with the current company, and being begin to identify and set up a merger committee, the roles and responsibilities, those individuals are gonna corral all these questions that are well scripted. And, as we see in the day to day concerns and the financials, the technology concerns, they’re all gonna be listed thereby having a, a merger group team set up when you’re lucky enough to go through the process of finding the right fit, the right conversations.

And then you get to the close, before you go in and announce the potential merger acquisition, is to give the first line of conversation to that merger committee. Two things are gonna happen there. One is most importantly, you’re going to answer all these questions. You’re gonna build internal advocates with the new group. You’re gonna table all the possible questions that the staff and the groups below you are gonna run into, what is it what’s gonna happen after what happens next? And that’ll be key. And then when the announcement does come, then you’re structured and prepared to ease those questions, because at the end of the day, if you are lucky enough to get across that line, the first and most important thing is to protect that investment.

And yes, you know, the IT model and structure is very key, but to me, the resources also just as key as what it’s gonna look like in your portfolio, after you successfully smash the two companies together. So that’s the piece of advice to that. I would highly recommend for anybody about to go through the process and if you are successful is to take that, cautionary step, take that extra breath and, put that team together. And you’ll find that these key people, they’re internal advocates and, they’ll do a lot of the answering quite for you and really buy you some time to move forward. And in the, well, I guess the extremely hard work you’re gonna have for the next three to six months to intertwine two companies.

Tom: Yeah, I would add to that, if I may. That circumstances of the sailor, the transaction will obviously dictate to some extent the communication strategy, but fundamentally people want to know they’re secure. So, you come back to James’ original point. So, there may be depending again, on the transaction timing, there may be, different people find that a different, different points of, of the process. But you have a transaction purpose. There’s a reason why you’re transacting and why you’re putting a couple of companies together. But it’s important to remember that people in individual areas need to understand exactly how it applies to them. So, people want to know, are they secure, but also what role will they have going forward? And so I think that touches Devin on some of the other, other bullets on the slide here, who will I be reporting to, where will I be working, what are the practical things that will change for me? And I think, again, that depends very much on the circumstances. Is there, is the transaction happening because there’s a missing piece in a larger organization and you’re looking to, really keep the acquired entity intact, is it a similar business? And you’re looking to get, synergies together and cost savings and you’re sort of amalgamating. So, a lot of those things they need to be thought through, but again, just to reinforce my original point there, we’re trying to make sure that people understand how it matters to them. How will it affect them individually? And then they can participate in making sure it’s a success from there.

Hartland: Yeah. And I, I think, the interesting thing about this topic is that we have, three stakeholders, right? We have, we have sellers and we have the employees himself. And although this conversation was triggered by the request that came through from an employee on the receiving end, we’ve got these three stakeholders, all of whom, have a vested interest in a successful outcome. So, you’ve got, you know, from a buyer’s perspective, if as a buyer, you might be focused more and you probably would be by default focused more on, well, is this the right fit for us? In terms of the customer base in terms of the services provided, is in terms of the location, revenues, is this, is this, kind of the right target for us, et cetera. And then, and everything else becomes a sort of ancillary secondary, thought, or afterthought, but, you know, the staff are really important. And a lot of buyers these days are looking at acquisitions, not only for the customer base revenue, revenue stream associated with it, but really looking at it as an Aquahire, right? So, they need the people, they need their resources, they need the expertise. and particularly if it’s a niche market or a technology or, and just even the intimate knowledge of the, customer base. And, as a buyer to have, employees who are motivated to stay and feel like they, their world wasn’t just turned upside down. There’s an incentive because the boat won’t be rocked, the customers will be happy and customers who are happy stay, so you don’t have to put the churn.

And then from the seller’s perspective, often to time, certainly, with MSPs, less so on the hosting front, but within an MSP environment, most of the time the buyer wants the seller to stick around for some period of time. Now it may be three months. It may be a year or more, but, and it’ll vary, but, they’re gonna want them to stick around. And, and so, the buyer sticking around will help with the employees sticking around because they’re gonna feel some continuity there, at least for some period of time that the person that they’ve been working for a long time is still gonna be a part of this process. And they’re going to, you know, the seller, also is, is got their own, issues and questions, right? Because, well, who will I be reporting to? I mean, I’ve never reported to anybody before now. I need to report to somebody who is that person going to be, and where will that be? And what are my, the expectations before I could come and go and do what I want when I wanted now, maybe I can’t do that. So, there’s these questions on these different levels. And, I think it’s why it’s such an interesting topic because, there’s sort of so many stakeholders, but, you know, I really, I like choice point, of having a committee, because I think a lot of this, it doesn’t get thought through well enough in advance. And so taking an inventory, with the seller of, of kind of, well, what is the culture at your company, right? Do we, I’ve heard stories where there’s, Friday afternoon, we, we do our, our, you know, our drinks, right? Whatever you call it, happy hour, or, a, we take Friday afternoons off at our company. Well, the buyer company doesn’t take Friday afternoons off. In fact, they work right till six o’clock every day. So now what do you do? you need to make sure that, that, there’s gonna be some way to address, you know, very different, environment there.

Devin: Yeah. Great points there. and so just one, one thing I wanted to ask and kind of trying to think about this from the employee’s perspective a bit too, is I can imagine that every company who makes an acquisition probably tells the employees that no one’s gonna lose their jobs. Right. And then inevitably it happens, at some frequency. See, so I guess the question is really, how do you come across credible when you’re making that sort of a statement, so that it’s actually felt, genuinely by the, by employees

James: I’ll chime in and, and just say, normally, you know, that upfront, you know, it’s part of the due diligence on the front end when you analyze the staff and most of the transactions that I was involved in most of the time, back to Hartland’s point, you want to maintain that culture and maintain that, all the employees, you know, you may need to pull one or two out of the equation cuz you don’t need those, but you wanna address that right away way. And back to the story that I had, you know, you wanna put their minds at ease so you can communicate, you know, everybody here has a job here’s who you report to. And pretty much across the board, all the transactions I was involved with, the expectation was, Hey, we’re gonna take this existing core team. We’re gonna plug you into the headquarters office with all these other resources behind it. And we wanna grow, we wanna grow the local marketplace. So we’ll be adding additional staff of superstars, just like you are, to the mix. So, but normally, you know, that, I would want to identify that in the due diligence on the front end. So coming into any conversation, you’ve already, removed people that you aren’t gonna have. And, cuz that’s a, that’s a really important point, Devin, that that’s a culture buster right there. If you say one thing and you do something else, that’s not how you wanna start an engagement.

Hartland: And, I think that you know, from the, I’m not involved in the due diligence, so I don’t have full visibility into, some of these, you know, the analysis that goes into it, but from a high-level perspective, I do know that, oftentimes, the recommendations will also come from the seller. Look, you know, I have these 20 people, these are my, a players, these are my B players. And then, these are some that, that there’s, there’s some problems that I have concerned with and you might wanna kind of, take a look at these ones a little bit more closely. And then of course, there’s some people who may be great. It’s just the reality is, is that they’re, they’re redundant. And they just not needed. And they’ll, you know, oftentimes they’ll know, they’ll if they’re, if they’re aware of the process for it in the beginning, and sometimes they’re, they’re the ownership level too, right? So someone might be the CFO, well, now we don’t need a two CFOs, so, that person is gonna go and, and if they’re part of the ownership team, they’re already, kinda tuned into that fact, but if they’re not, then, you know, these are conversations that have to be had and, and probably should be had, you know, con right away concurrently with, with everybody else. So, there’s no rumors, being spread.

Tom: Yeah. The other consideration is that with a, with a larger company, making an acquisition, sometimes there’s new opportunities as well. So it’s not simply a case of will my job stay the same, will I lose my job, but actually there may be an opportunity to learn new skills to move into new roles. So I think there’s, there’s a positive spin here as well. And I think during the due diligence process, you want to identify some people that have a high potential, and maybe you’re looking to bring them into, into the group level, and you’re looking to give them new opportunities and, and enforce the overall value of, of the group management as well at that point.

Troy: Yeah. That’s a great point there to, just to add to that maybe on, of the reverse kind of psychology of, you know, we definitely want employees to stay, reality is, you know, when you do put two companies together, the daily pace of their environment, may increase, to something that they’re not normally, you know, accustomed to. So meaning, maybe have a great it firm smaller, you know, maybe 10, you know, 10 employees and under, and their daily routine has been pretty calm, nd all of a sudden they’re gonna be into new new processes and procedures, and a faster-paced environment. And, you know, they’re excited from maybe day, you know, 10 or 12 on, but the reality is after three to six months, maybe they don’t have a skillset for that fast paced environment, you know, where you can take advantage of those extra opportunities because that is definitely more, more salary, more income, but then there’s more responsibilities, more fast-paced. You know, those are please go aside inside, but you will, you will have some type of churn, you know, with staff that decide, you know, what, I’m gonna go realign myself with, you know, my, my, my current workflow mentality. So that’s just something to keep a, you know, keep in the back of your mindset as well.

Devin: Great. Well, I think, we can probably move on from day-to-day concerns. That was some great insights there. And, we can also talk about some financial concerns from employees. So these are things like, what will I be paid? Will I be better or worse off, how will performance be evaluated? What will my role goals and object objectives be? Will I be signing a new contract, who will pay my vacation pay? So some of this, picks up from what Troy was just talking about. but, what comes to mind for you guys, when you think about the financial concerns for employees going through this transaction?

Hartland: I mean, I, I think what I’ve seen, oftentimes is that the buyer will try to, assuming that they want to keep the team. And, and generally that is actually the case that they will be providing some incentives to, to the employees. So, salaries will be, increased, benefits will be improved, you know, kind of perks associated with the role, would, would improve and, and so forth. So that’s oftentimes what I’ve seen, as, you know, part of the, the kind of incentive, process and, and taking inventory course of, of what the existing, structure is, how much the existing employees are paid, how many hours they’re working, what their, expectations are. I mean, I know, Troy, for instance, you’ve got, some pretty cool things that, that you’re doing with, con pension, contribution. Right? So there’s providing, a bit of a lift overall. I think the, you’ll circle back, if someone else doesn’t cover the vacation pay and, and the new contract. Cause I think that’s, those are two important points, but I’ll, I’ll pause there.

Troy: Yeah, I can, I can add a little bit it, you know, to that. And, I think with, having those little, like you say, incentives, and, so that helps speak to being in a large organization, you know, what’s in it for you, right? So usually that does come with some bit of a salary or income compensation bump, because you are already identifying that their workload’s gonna increase to some, to some level, you know, but it’s also important to note that, there’s time for there’s two types of sales and asset purchase agreement is a smaller in nature and we’re in reality, you’re just buying the book of business in, in the client base that comes over and you just start to implement and, and earn those new contracts under your brand. the next, you know, with a sale purchase, you know, the purchase share agreement, you know, that’s different, you, you have time, you know, there’s gonna be a lot of considerable time to one, one down, if that is the end goal.

So when it comes to vacation pay, the books are gonna be managed, by one quarterback, but in the interest of the direction of where the integration is taking place. So, for our group, obviously signing into a new contract comes in, with our IT P partners logo, that’s where our better health plan is. That’s where our compensation plan is. That is the legal document that puts us on the hook to say, we’re gonna pay all these wonderful things. We’re gonna get you access to our pension plan. We wanna improve your lives and, and kind of, you know, nail a lot of those questions about roles and responsibilities, vacation pay that becomes administrative in, in my books, whether, you know, whether our bookkeeper pays it from the other account while it’s winding down, you know, but the end goal is to move it all under, you know, for us, our QuickBooks, data files.

James: So, Yeah, I think, I think all of these six questions are critical. And the first thing I’d say is they all need to be crystal clear in writing back to the employee that you would want to retain. I was always a big fan of either retention bonuses, but more specifically, increased performance commissions or bonuses, you know, you’d either want to equal or increase a little bit are their salaries, but you would wanna be able to demonstrate that here’s an opportunity for you to make a lot more money based on your performance and achievement of goals. the, the one on the very bottom Hartland will probably talk a little bit more about this, but, you know, who will pay my vacation pay. There was, I think it was that very first transaction that I was involved with. I was, there was a staggering number on, on the bottom of the spreadsheet of the outstanding vacation or accrued vacation pay. And, in that transaction, it was recommended that the seller, pays that out before we would sign them on a new contract, you know, they had to, we go on, on our contracts, and would recommend that. But, I don’t know, in most cases I would say that the liability of the outstanding vacation pay, should fall back on the, on the seller. and in some cases, you know, that can be easily overlooked and that number can be pretty substantial. so, that’s something you wanna look at.

Troy: Yeah, that’s a good point, James, I think, for those that are embarking on this, depending on the time of the year and your fiscal year, yeah. You’ll be admins, what’s called, I guess basically a, a stump here end. And that will start to get that, that pivotal point on, you know, what part of the networking capital you’ll be adjusting that is owed by the, you know, the firm that got acquired pre April one date versus post April one date. And again, I think if you leave with the employment contract and getting them signed up, the vacation pay comes under their group, and then the payout will come from the networking capital.

Hartland: Yeah. So, I agree with James your point about this being a potentially big issue. T these are the types of things in a transaction that, nobody really worries too much about until the end. And I find out, geez, there’s this huge liability, and who’s gonna pay this and you gotta come to terms with, with it, particularly with COVID because a lot of, vacations didn’t happen. And so you ended up with this, this, accrued, you know, pay that, that needed to be, dealt with and, or time, I mean, the other thing is time, right? They’d accrued, six weeks of vacation that they hadn’t used. but generally speaking, it, it is the buyer, sorry, sorry. Excuse me. Is the seller, excuse me, who would pay, the vacation pay as well as any other liabilities up until, the point of close. And so this kind of brings me to another issue which can freak, employees out certainly is that they, do end up, in an asset purchase agreement. They do end up, being terminated. However they get simultaneously rehired, you know, at the same time, the same day. So, the liability associated with the, prior the periods prior to close become, or remain rather with the, with the seller and then the buyer kind of has a clean slate, going forward. So that’s typically what we’ve seen is a simultaneous termination and, and rehiring process. And of course, as, as we said, under a new contract with new, and hopefully better terms, if it’s, a share deal, and, and Troy is, you know, recently done one of those, then a little bit of a different story. And so, yeah, it’s an adjustment to, to working capital, at that point. But of course a new contract can also be, signed.

Tom: One thing, Hartland that I would, regards to an asset sale. And, and what you described in terms of the simultaneous sort of, termination and new account. I would highly recommend that people look into employment law in their jurisdiction and where the transaction is taking place. And you may need in, certainly in one instance, we’ve certainly had to, put protection into the actual asset purchase agreement with regards to the liabilities. Because I know in Canada as an example, they, the courts do not necessarily see, the liability and, and I’ll, I’ll take severance as an example, as an acquirer, you’d like to think that when the seller has terminated, they’ve taken on that responsibility, they’ve paid out severance, the Canadian courts may you that differently because they essentially have had a continuous employment with the, with the business they were involved in, even though the ownership has changed. And so, I think what you’ve described is certainly our experience for the most part, but I would, I would highly recommend getting some legal advice on that point.

Hartland: Yeah, that’s a good, a really good point. and we’ve encountered that issue as well. So, yeah. Thanks, Tom.

Devin: Great. Well, maybe we can move on to the, the cultural is, concern slide here too. So, for this category of concerns, we’re talking about things like which name slash brand will the company take. What’s the direction of the new company? What are the goals, what will the companies cultures be like, and will they synergize? And how will I adapt? How will I adapt to new company culture and what steps will be taken to get there? Does anyone wanna start off, on this topic?

Troy: Yeah, I’ll just, I’ll take a quick lead on this, culture is, is key. If you wanna retain your employees along with the financial and making sure you’re protecting your investment, what they’re used to and they do well and what you do well, all goes back to that, initial, merger committee, and setting that up to what that’s gonna look like. And that should be a major, task item to review, and implement. I wouldn’t stress enough that that is, that is, that is key. when it comes to culture, that’s the integration that you look for, as, as part of one of your tick boxes when you’re looking at making a final purchase. but that is a key concept and, these are great. These are great questions. And I think if you stay ahead of it, you’ll have, you’ll have more, more opportunity to protect your investment when, when the news is, when is brought to everybody and dropped on everyone.

James: Yeah. Yeah. Good, good point, Troy, the, when, you know, culture is key, and one thing I would look at very closely is the company who’s getting acquired. Are you going to of retain any of the leadership in that organization, or not, and, in many cases you do, and something that I’ve seen work really well to embrace those cultures and get everybody on the same sheet of music as, I’m an EOS implementer as well, and work with both leadership teams together and take them through there’s 12 exercises that I would walk through to build out their vision traction organizer, which is a, a two-page document. And then at the end of us completing those exercises, we build a presentation deck and present it back to the entire company. So both leadership teams, you know, had their fingerprints on the updated core values and the goals and the direction and the 10 year roadmap of where the business is going. And then you need to communicate that to the entire team, to really embrace that culture and get everybody on the same sheet of music.

Hartland: I think the, I was gonna take the first point here about the name and the brand, that the company will take. So now this is often a question that the seller will ask, of a buyer is what, what do you gonna do with this brand? And in some cases, the seller doesn’t care. they’re just, it’s kind of more of a curious question than anything else. in other cases, they do, because this is their baby. They’ve built this, this for quite some time. And, and now the buyer is simply just gonna kind of fold it in into their, their brand. And so, it’s a little bit of an affront to the seller to now, kind of have this, this thing that they created, disappear, right, because it’ll be, it’ll be moved into the fold.

And so the employees, to some degree, especially ones that have been around for a while may also, you know, have this kind of feeling that that’s something that they’ve built and, and what they’ve built is ends up being, disappearing. So I think it’s an issue that, should certainly be talked about, in some cases it may just not be practical to keep it, there may be steps to, to take, and, and Tom, you know, your perfect example of this, because you’ve done many acquisitions with many different brands. but, you know, I’ve seen situations where the brand is maintain for some period of time. And then it’s, it’s a brand ABC part of X, Y or Z company. and then, and then it’s a, you know, an X, Y, Z company, formally ABC, right. And then the ABC eventually just disappears. But, it is an important, consideration and you know, as far as the other points go talked about, cultural already. So I, I think looking at these kind of cultural artifacts and norms, and taking an inventory, taking stock of, of what exists in, in the company right now. So as they say, do people, not work on Fridays, do they, do they have a, once a month, kind of, thing that’s, that’s done once a month, we, we go and we bowl together, or we have a company kind of, you know, softball team or whatever it is, what what’s gonna happen to, to these things. And, and in some cases, you know, maybe that the buyer likes the idea and, and, and kind of rolls it out. In other cases, there might be a better, something that’s better than, than what is even being done. But I, I think it needs to be, you know, addressed and communicated and, and, and, and mitigated. And of course you’re not gonna, appease everybody. But, reality is, there is gonna be change, but, not to overlook the importance of some of these things.

Tom: Well, I, I think it’s vital to recognize that these are relationships. So, you have to invest time and energy in, in making them work. And sometimes an acquisition happens quickly. And in terms of the goals, it may be difficult to determine, very, very clearly a long-term plan, but, you know, there’s a short-term need and a fit. And so as a buyer, you need to, you need to really evaluate where the value is gonna come from in a transaction. But then you need to be able to within a comfort level, you have to be prepared to invest the time and energy in, in working with the people that are coming on board, making sure they understand what you’re about and what you’re trying to achieve. And even if you’re not able to set out a 10 year plan at that point in time, helping them to understand the approach that you’re taking and how you want them to be involved in that again, will make a big difference, to their comfort level as to, you know, what’s going to happen. And when, and it will engender, I think a sense of, patience, which in the absence of communication, which I think is a big failing in M&A transactions. A lot of times, on the communication side, people get nervous. And so if, if you’re not clear about the fact that something will happen or something is being worked on, and this is what the role of, of the individuals are, is going to be, people will assume the worst, they get nervous. They wonder whether or not they, the, you know, we, we were promised that we’re gonna keep our jobs, but actually in six months time, I’m gonna lose it. And, and it’s that, it’s that I sense of integrity and, and trust that gets lost. So I think you have to be clear with people. And I think being honest and upfront about something like the name of the brand is important as well. And even to the point where, you know, you don’t wanna do a deal and then have a disgruntled seller, because as part of the negotiation, you said, yeah, we’ll keep the brand. but then subsequently you, you immediately retire it. So I think all of this comes down to having honest trend transactions and, and trying to make sure it’s a win-win for both parties.

Hartland: Tom, because you’ve rolled quite a few brands into, host Papa, what, if any challenges have you seen around groups wanting their brand held onto, or the team kind of feeling like they’re, they’re associated with that brand end? I, I know this can be a particularly big issue, and I don’t know if it’s happened with you where, where, this happened for a number of other hosting brands years ago, where, the companies were acquiring, they viewed each other as competitors. And, and so what was happening was is that the, the, as the buyer continued to buy up other brands, and, and these were competitive brands there became this, still this competitive culture within the company, where it’s kind of us and them, even though it was, everybody was now an us, they’re still maintained that us and them mentality because for years they had been rivals, essentially. So I’m just curious how, how have you?

Tom: Yeah, I think in, in our experience, we haven’t found employees, to be, you know, desperately attached to the brand a lot of time. I think they want to be gainfully employed. They to have purpose in their work. They want to be part of a team and a culture that they, they like, and that matches, you know, their own beliefs. I think it tends to be the seller who perhaps, created it has run that brand for 20 years. It’s, it’s their baby. It tends to be the sellers. I think that are a little bit more attached to the brand name. But in terms of competitiveness, you know, I think there’s an element of that, but I think the way that we’ve, we’ve always tried to overcome it is to, is to really focus on integration. So bringing people on board and rather than leaving individual business units, in our scenarios, we tend to integrate them into their functions.

So you don’t have, five or six different development groups in under different brands or, or different lines of business. Typically, you have it more centralized and that allows, individuals, to stretch beyond what they’ve been doing traditionally, and to work across other projects with other, other developers. And certainly, when you’re acquiring a small group of people who have worked in isolation to a large extent, one of the big benefits of a, of an M&A transaction tends to be that they get to work with other people that have, you know, similar interests, similar skills and, and other people that they can learn from. And we often find with some of the smaller shops, you might only have a couple of people doing a particular job development as an example, and some of those people like to, to have peers. And so that’s part of the integration and getting them to be bought into what we’re trying to achieve as an organization

Hartland: Yeah good points.

Devin: Well, thanks, Tom. And so our last set of concerns here are technology concerns. So these are things like, do I need new training, will the tools and systems I’m familiar with beach, how well documented our new procedures? Well, the skills and expertise I’ve gained be seen as valuable. so, you know, a lot of these are really at the kind of the core of, how technical employees see their value and, and self-worth and things like that. So, you know, these are very significant, concerns. I’m, I’m curious what you guys think about these.

Tom: I think to some extent, it depends on the nature of the transaction again with this one, Devin. So, certainly, and I think it was mentioned earlier in, in the call, if we’re making an acquisition for a technology, then the individuals coming on board are, are managing something unique. It’s something that we don’t necessarily have expertise in. We don’t necessarily have people that are able to, to run that. So you may keep them and, and have them focused on that. And, and the training could actually be reversed. So it could actually be leveraging the skills and knowledge coming into our organization, and spreading that knowledge, to help the broader group, in terms of tools and systems. Again, I, I think it was also mentioned earlier that generally speaking as an acquirer, you have systems and you have tools that you try to want to have standardized across group as much as possible from an efficiency standpoint. So yeah, that’s, that’s an area where someone may need to, to change, but, you know, again, from a hosting perspective, we often find, the companies we’re acquiring are working with the same sorts of technologies that we are anyway. And so there’s not necessarily a major, major shift there. And then in terms of the skills and expertise for, you know, to close for, for myself on this, I would say that it, it points back to, is it a, like for like acquisition, are we acquiring somebody who, or a business that’s doing the same thing that we are today, or are we acquiring them because they offer us something entirely new and somewhere on that spectrum, you’re gonna find that you, you may have very unique skills that you’re bringing in and, and you can actually help us to grow as an organization. Or you may find that, you have peers that have similar types of skills and you can, you can join a large group of people with those skills and, and find new ways to apply them.

Troy: That was a great point, Tom, I’d just like to add just a small item and, and, and when you are doing your due diligence, for an it MSP and being an acquire, you do look for a certain tool sets and what that’s gonna look on the integration side of things, because those are, those are hitting costs. so you wanna make sure that you identify what type of integration challenges you may or may not have. but I would guarantee you’re gonna see some type of, out of scope, you know, pop your head if you’re not aware of, you know, a strategy when it comes to, you know, connecting processes.

James: Yeah. I wanted to mention a couple things here. The one, one key, super valuable asset that isn’t normally on the balance sheet is the people and, you know, their skills and expertise, and especially in today’s workforce shortage, acquisitions and acquiring talent is very important. So, you should be looking for those skills in and expertise with the people that you’re acquiring and, and embellish them, and training. Absolutely. There should be due systems training just on the new company, the processes, the tools, in some cases you’re acquiring some of their tools if they’re better than yours. and, and there’ll be some reverse training, like was mentioned, and hopefully, the procedures and the processes are well documented. and, and most of the time that’s the case, but not all the time. So, but I just wanted to address the people part of it, because that’s, to me, one of the key reasons why the acquisition would be a, a win-win is if you’re looking for talent.

Hartland: And, and, you know, just, from my perspective, I don’t get to info in, in this, really, these types of questions, they’re, they’re really end up falling on the, the shoulders of primarily the buyer, but, certainly, you know, James, you would back up and you know, Tom, you said it is, is just the well, and Troy of course, there needs to be, a commonality amongst the tools, and platforms and systems that are being used. Otherwise the, the costs, just become a prohibitive, to try to keep up with all of the new, you know, updates and different customers using different tools. In some cases they may be somewhat redundant in others. They’re both, security tools doing the same thing, but, just different, competitive solutions.

So, do a lot of times that’s a screen in the beginning, as well as part of the transaction, but, you know, it’s hard to line them up a hundred percent. And so at that point, decisions need to be made. And so some of the tools that someone’s familiar with may not, end up, remaining, as, as, you know, kind of going forward. but, you know, as Tom said, I’ve also seen a lot of times where there’s discussions and, a little bit of a kind of humor comes into it when the, the buyer says, well, we were on this platform and the seller says, huh, we used to be on that platform. We changed our platform six months ago, but their team, I at least knows the platform of the buyer. So they’re not, they’re not having to go to something they don’t know. Now they’ve moved out of that system and it might be six months or a year ago that they last used it. but, there’s still some familiarity, with it. And, and so, you know, that’s, that, that often kind of mitigates, some of these things, but, you know, you are gonna have employees who will not be happy with certain tools. They’ve moved away, they’ve made a decision to move away and now they have to move back and you know, that that’s gonna have to be, navigated as well.

Devin: Great. Thanks Hartland. So that’s, that’s all the slides for today’s presentation. And, I wanna thank everyone for their time. James, Troy, and Tom, those were excellent insights. you know, I, I hope that, you know, our poster on Reddit, if they get to see this, they’ll have a little bit more of, insight into what they can expect for the coming months post transaction. And I hope if you’re, an owner or in the, a leader in a Nike service firm and, you’re on the buy side or the sell side, you got some good tidbits and, and wisdom about how to make sure that the transaction goes smoothly as well. So, thanks so much everyone for joining today. You know, if you’re watching on YouTube, please be sure to subscribe. you can reach out through our website, The Host Broker.com, [email protected]. If you have any questions and, we hope to see you next time. Thanks so much.

An interesting new blog from one of our partners, HatchIt, which is a platform for aggregators, entrepreneurs, and investors acquiring online and tech companies. They’ll share with us the reasons why you should hire a business broker.

As a business owner and entrepreneur, you’ve likely poured your heart and soul into your company. So, when it comes time to sell, how can you ensure the best possible outcome? Hiring an experienced business broker is a great place to start. Here are 7 reasons why you should consider hiring a broker to help sell your business:

Determining the value of your business requires both knowledge of valuation methodologies and an understanding of the landscape of buyers. A good broker will know how to properly normalize your income statement and how to apply a multiple-of-earnings assessment or alternative valuation methodology. Equally important, a broker will know whether your business is a candidate for a strategic acquisition, and how to price it accordingly. Finally, buyers prefer to purchase businesses represented by a professional because the financial information has been vetted by a third party.

An experienced broker will know how best to position your business to attract qualified buyers. Quality marketing materials, including a “teaser” summary and comprehensive overview of the business, will help attract the best buyer candidates and weed out unsuitable buyers. Brokers may also list your business for sale on their website as well as marketplace websites to target acquirers of businesses that fit your size and profile.

The universe of potential buyers for your business may be wide and diverse – from individual entrepreneurs, search funds, and fundless sponsors, to strategic acquirers, private equity firms, and aggregators. There are pros and cons to each. A good broker will have in place a robust buyer network, as well as resources to reach additional candidates, so the right parties are at the table. Additionally, a broker can help screen buyers to ensure they have the financial wherewithal to acquire your business, and the right skills to operate it.

Purchase price is just one component of an offer. Deal terms, too, significantly impact the attractiveness of a proposal. Is the buyer seeking seller financing or performance-based compensation? Are you required to stay on for a lengthy transition? A broker can help you navigate terms, make informed decisions, and communicate effectively with the parties involved. Additionally, business acquisition negotiations can be emotionally charged. An experienced broker will help the parties keep emotions to a minimum and stay focused on a mutually beneficial outcome.

Running a sales process can be time-consuming and exhausting. In addition to preparation, the seller will need to manage multiple negotiations and respond to ongoing requests for information. Most business owners have their hands full just running their business. So, it makes sense to outsource much of the effort to a professional. A broker will help you avoid any business performance issues that might emerge if you are pulled in too many directions during the process.

A sales process requires disclosure of confidential information to multiple parties. Without the assistance of a broker, it can be difficult to confidentially engage with potential buyers. A broker can approach buyers, even competitors, with a “blind teaser,” followed by a non-disclosure agreement (NDA) before any information is exchanged. Likewise, a broker is less likely than a business owner to inadvertently alert employees or other stakeholders of the sale.

There are a number of legal documents involved in a business sale transaction, including an NDA, Letter of Intent (LOI), and Asset or Stock Purchase Agreement (APA or SPA). While it certainly makes sense to engage an attorney when developing documents, a broker can help defray legal costs with access to boilerplate templates, past agreements, and a working knowledge of the key terms and opportunities for negotiation. Leveraging the knowledge of a broker to help with these agreements, while engaging your attorney for document review and counsel on key deal points, can be an effective division of labor. Finally, a broker can assist in the transfer of assets at the conclusion of a successful sale.

We hope this information is useful as you consider your options for selling your business. We operate The Hatchit Marketplace, a platform for both for-sale-by-owner and brokered online and tech-related businesses with valuations ranging from $25k to over $20 million.

The Hatchit Marketplace,

LLCResearch Triangle, NC

hatchit.us

The journey of a CEO with special guest Dennis O’Connell. We’ll take you through the various stages of building and exiting a business. Learn how to navigate owner changes, personnel changes, sales strategy migration, financial evolution, the process of maturity, and how clients are viewed throughout the process.

Hartland Ross: So welcome to today’s session.

I have the pleasure of introducing you to Dennis O’Connell with Taylor Business Group and Dennis is joining us from Nebraska, right?

Dennis O’Connell: You bet. Omaha.

Hartland: That’s what I thought. So excellent! And I really appreciate you joining us today. Dennis has got a topic here that…we’ve done quite a few sessions now over the last number of months and this is one that is really quite a departure I suppose from some of the other topics that we’ve talked about. So I’m excited to learn from Dennis and our own kind of comments and sharing. So a CEO’s journey from inception to exit and I’ll turn it over to Dennis. He can introduce himself and talk to you a little bit more about Taylor Business Group and then we’ll jump into the session. So thanks Dennis. Take it away.

Dennis: Hartland, hey, thanks for the opportunity to do this webinar with you today. I’m Dennis O’Connell with Taylor Business Group. I’ve been here for just about four years now. I’ve been in the IT business in one form or another since I joined the Air Force and was an Applications Programmer. I did a stint with the Air Force. I worked for a company called Tandem Computers that got bought by Compact Computers that got bought by Hewlett-Packard. So I’ve worked with very large companies and I worked for a very small MSP for a number of years. So I understand we all have been and I’ve essentially been in the MSP channel for about the last nine years. So I enjoy working with small business owners.

I enjoy hearing your story. It’s fun to do that. So this presentation is really a story of the different areas that an MSP owner needs to be. We’ll see as they grow.

So we’ll look at it from inception, you’re a one-person company and now you’re going to go all the way and look at these different areas within your business as you grow and mature.

So you will change, your personnel will change your sales, will change your financial maturity will change, the clients that you’re looking for will change and how you grow will change over time. So we’ll look at each one of those separately. And it’s a lot of fun hopefully and as we go along if you have questions go ahead and type them into the chat.

I think Hartland is going to monitor the chatbox and he’ll interrupt me with questions and we’ll go from there.

So let’s talk a little bit about the owner when you started your business. Most of the people in IT today started their business because they were working for somebody else and they felt “Hey! I can do it better” and so you go off and you start doing it yourself and you start to grow and pretty soon you have a business, right?

The first thing you got to do is you’re successful and you’re going like crazy and you don’t have enough time and then all of a sudden you got to hire somebody and now your world changes, right? So how do you learn to hire people? How do you learn to get the right person to understand the process of hiring?

So you have to do all that type of work to grow and the people that you’re hiring have their own needs and so you need to learn to do that as you’re hiring people eventually you’re going to decide where you hire your first manager and I think the hardest part about hiring managers to learn how to delegate you have to…when you delegate that’s something that’s from the heart and from up here is being able to to do that, showing them how to do it and then they’re going to do it differently than you. As long as they get to the endpoint that’s okay and sometimes they’re going to make mistakes and fail and that’s okay. You can use it as a learning moment and then your job is to coach them along. Don’t hold their hands. Have them always come in and ask you “Hey! I need some help.” Ask that question, “Well, what do you think the right answer is?” and then kind of talk through it from there as you create a management team, do you hire from outside or do you promote within.

That’s a hard decision because a lot of people will take their lead technician and hire him up to be a service manager and that person’s really not good at managing people. He’s a great technician and so, you need to evaluate the people constantly, and then as you hire and you build up your management team, you need to become a real president, a real CEO where you now have your management team that’s running your business and you’ve stepped away.

If you look at how this goes from a sizing perspective you know typically hiring your first manager, you’re 6 to 10 employees because you need the service manager when you start creating your management team, you’re somewhere between 10 and 25 employees and then you becoming a real president is a little later, after that and I think I have that in another slide here.

So let’s talk about the personnel that you have. When you’re small you need uh technicians who are well-rounded right? If you have only one or two technicians you need them to be able to help you, do the BDR type stuff, do security, do RMM, be in the PSA, take calls, all those types of things. So you need somebody who’s very well-rounded and you’re going to need as you grow one two, three, four five, six of those. At some point in time, you have enough of them and you’re managing them. That’s like…we talked about…I was hiring your first service manager and really that’s a key hire. With a good service manager, your employees will be better because the service manager will be able to focus on the services side while you can go over and then start focusing on running the business.

As you grow, you will need to start having specialization within your staff. So you know when you have 10 techs you don’t need them all to be special generalists. You typically have now grown to where maybe you have one or two people that are focused maybe on just doing projects you might have somebody who’s just focused on keeping your tool set up to date. So making sure and applying patches to whatever the toolset went, what could be whether it’s Auto Task or Lion Gard or ID Agent or IT Glue or you know ConnectWise Manage whatever it happens to be you need to have somebody that’s focused on that and what you’ll find is that sometimes the folks that you had at the beginning who are generalists don’t want to be specialists and that’s where that statement is. Maybe the people who got you here are not the people that will get you their means.

So you need to constantly evaluate your business and your employees so that the right person is on the right seat of the bus. A gentleman who I respect very much and I worked for for a number of years who owned his own MSP who grew it from…he was employee no. 5 and you know they were up to 15 million when he left as their president, used to say that every 18 to 24 months he needed to re-envision and re-imagine his business. So he needed to take a look at all his people. He needed to take a look at – Were they the right people? Did the roles change? those types of things and so it was important for him that he had in his mindset that he had to do that regularly and as you grow and as you run your business you probably need to do the same thing.

And even in today’s world even if you’re not growing, you need to reimagine your people because two, three years ago security was a small piece of business and now security is becoming more and more important. And so do you have the right people on your staff to be able to handle today’s challenges?